Click HERE to return to the contents page

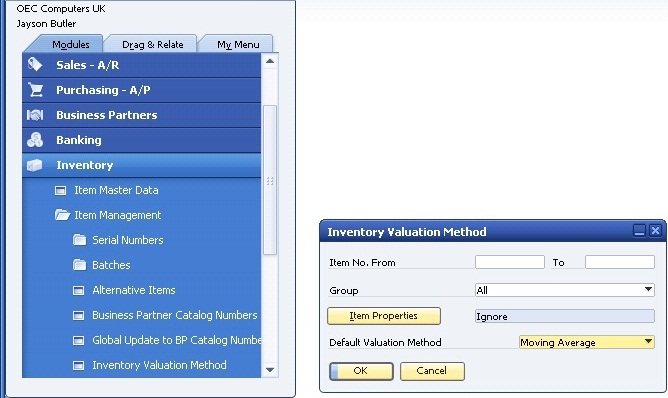

II. FINANCIALS [Time: 248:56 min.]

Manage the Chart of Accounts [Time: 25:23 min.]

We will discuss the Chart of Accounts structure and the effect of standard processes on the Chart of Accounts.

Your are implementing SAP Business One at a new customer:

Reflection Question: The Chart of Accounts

How are the Business Partner Master Data balances presented in the Chart of Accounts?

The Business Partner Master Data balances do not appear in the Chart of Accounts.

Control Account

Debit Credit

[411] Account Receivable (Customer)

105

[4427] Tax Account

5

[701] Income account

100

The Receivable [411] and Payable [401] control accounts accumulate the customer and Vendor transactions in their balances.

For example, when you post an A/R Invoice, the [411] Accounts Receivable account related to the Customer is used, in addition to the [411] Customer Account. Therefore, the Chart of Accounts presents the complete financial status of the company, as well as the Financial Reports (Profit & Loss, Balance Sheet).

The Chart of Accounts is an index of all G/L Accounts used your business.

Every G/L Account has:

- An Account Code and

- Account Description and

- Other information that determines the functions of the G/L Account.

When you implement SAP Business One you define (or import) the Chart of Accounts.

Default G/L Accounts to be used when transactions are created in the different business process: Sales, Purchasing, Inventory and more.

The documents in the Sales and Purchasing process create automatic Journal Entries that are registered in the Journal Entry file and affect account balances.

The account balances are also affected by manual journal entries and other accounting transactions. For example, the Period-End Closing process that the balances of the Profit and Loss accounts to a Balance sheet account.

Define Valid Legal Chart of Accounts

You have 3 options for defining a Chart

of Accounts:

1. Select a pre-defined Chart of Account template. This option could be

suitable for a standard company, especially a new company without a legacy Chart

of Accounts. Note that once you have standard to work with the company database

you cannot choose a different Chart of Accounts template. You can however add,

update or remove accounts in the Chart of Accounts.

2. Import the Chart of Accounts data from a legacy system.

For this using the Data Transfer workbench (DTW) tool. If the company wants keep

their Chart of Accounts, they can still reorganize the structure before

the import. Alternatively, you can,

3. Define your own Chart of Accounts. This option

allows you to create your own customized Chart of Accounts. An organization ca

use this opportunity to determine what the Chart of Account structure should

look like to accommodate their needs.

Defining the entire Chart of Accounts is a long, complex procedure. You can use one of the existing standard Chart of Accounts and adapt it to the company's needs. work together with the client accountant to decide on the company's Chart of Accounts content and structure.

Although using one of the existing standard Chart of Accounts could suffice in many situations, organizations can take this opportunity to determine what the Chart of Account structure should look like to accommodate their needs.

The Chart of Accounts is organized by drawers and levels. Cannot be changed, organize in logical fashion appropriate to your localization's financials accounting an reporting processes.

Chart of Accounts varies according to the company's localization. The organization of the Chart of Accounts follows Generally Accepted Accounting Principles.

In the General Ledger, we distinguish between Balance Sheet Accounts and Income Statement Accounts, also called Profit and Loss Accounts.

Let us start with Balance Sheet Accounts: The first 3 drawers: Assets, Liabilities, Equity (Capital and Reserves) hold the Balance Sheet Accounts, such as the Sales Tax account and the Accounts Payable account.

The bookkeeping balance of these accounts is kept from one fiscal year to the next. The Balance sheet Accounts - reflect the monitory value of the company - stock, assets, debit, etc.

Next, we have the Profit and Loss Accounts.

The last 5 drawers: Revenues (Turnover), Cost of Sales, Expenses (Operating Cost), Financing (Nod-Operating Income and Expenditure), and Other Revenues and Expenses (Taxation and Extraordinary Items) hold the Profit and Loss Accounts, such as the Income Accounts.

Note that in some localizations, the lower drawers are not all Profit and Loss account drawers.

The bookkeeping balance of these has to be cleared at the end of each fiscal year - this is the Period-End Closing process.

The Profit and Loss Accounts reflect the changes in the company value, such as: when you sell stock - the Cost of Goods Sold Account is affected and increase revenues.

Demo - G/L Account Properties and Account Details in the Chart of Accounts

In this demo we will review the Chart of Accounts Structure including the drawers and the Balance Sheet accounts versus Profit and Loss Accounts.

We will then focus on the account definition and review the account details and how they influence the financial process in SAP Business One.

Let us look at the Chart of Accounts structure (open the Chart of Accounts).

The first 3 drawers: Assets, Liabilities, Equity (Capital and Reserves) hold the Balance sheet Accounts, such as the inventory account, the bank account, and the Accounts Payable Account.

The last 5 drawers: Turnover (known in some localizations as Revenues), Cost of Sales, Operation Costs (known in some localization as Expenses), Non-Operating Income and Expenditure (also known as Financing) and Taxation and Extraordinary Items (also known as Other Revenues and Expenses( hold the Profit and Loss Accounts, such as the Sales revenues Accounts.

Choose the [401] Trade Creditors in the Liabilities drawer.

When I choose a G/L Account, the account details appear on the left Beside the account Code and Name I can see the account balance.

I can navigate using the orange arrow to the line item display of the account. In the line item display, the system displays the debit values in blank and the credit in green and parentheses. This is the Accounts Payable account and it accumulates all vendor transactions in its balances.

Note that the Business Partner Master Data balances do not appear in the Chart of Accounts.

The [401]Accounts Payable account in marked as a Control Account (checkbox) and therefore can be assigned to Business Partners.

The balance of the Control Accounts represents the total accumulative balances of your customers and vendors. It is not possible to post directly to a control account.

In the Chart of Accounts display, I can mark and account as Confidential. Only users with General Authorization to confidential accounts can see and use confidential accounts. In the External Code field I can enter an alternative code for the account. The alternative code can be used by external programs that you integrate with SAP Business One.

Bank Accounts: Choose assets, scroll to bottom, choose the first bank account. Accounts that I mark as Cash Accounts (with the checkbox) appear as cash accounts in the Cash Flow report. Generally, all your bank accounts should be defined as cash accounts.

Choose a Sales Revenue account in the Turnover drawer. In the Account Type field, I define a Profit and Loss account as Revenue account type (Sales) or [60*] Expense account type (Expenditure). All other accounts should have the account type other.

If I choose the Account Details button, I can enter additional information about the account.

An Alternative Account Name can be specified for the account. This can be useful when the company works in different languages.

I can set a G/L Account as Active or On Hold for a certain period of time.

A VAT Group (or tax code) can be assigned to the account as a default to be used when creating manual Journal Entry.

If I mark the account as Relevant to Budget, and I have defined a Budget, the system will apply a check before posting to the account.

Chart of Accounts Structure in Association with Financial Reports

Financial reporting requirements drive most of the initial settings and configuration decisions in the Chart of Accounts. The different financial reports run on the account balances relevant to a selected range and present them according to their drawer, level and type:

The Balance Sheet summarizes the value of the business assets liabilities, and owner's equity accounts.

The Trial Balance displays for each account: beginning balance for a particular period, all of the debits and credits, and the ending balance.

The Profit and Loss Statement is determined after the end of fiscal year.

The balances of the [60*] Expense Accounts will be subtracted from the balances of the Revenue Accounts to come up with the profit or the loss for the fiscal year.

Levels in the Chart of Accounts

a chart of Accounts arrange a company's General Ledger accounts in a hierarchical structure.

The top level in the structure (level 1) consists of sections or groups for different type of accounts (assets, liabilities, capital and reserves, turnover, and so on). The number of account groups depends on the localization that was selected when the company was created and cannot be modified by the user.

The system displays the section as a cabinet drawer.

Each drawer has a section title, which you cannot change.

The system displays lower-level titles in blue and normal Active Accounts in

blank.

Accounts that you have entered in the G/L Determination (default

accounts) are displayed in green.

The Chart of Accounts varies according to the company's localization. Let us look at this example Chart of Accounts that contains 5 levels.

Levels 2 through 4 can contain either Active Accounts or title that combine several Active Accounts. Level 5 contains only active accounts.

Because only Active Accounts can be posted to in SAP Business One, it is a good practice to have all your Active Accounts at the same level.

In reports, a title account summarizes all the balances of each Active Account below it.

Demo - Manage the Chart of Accounts

We will look at two windows for maintaining the Chart of

Accounts:

- the Chart of Accounts window and

- the Edit Chart of Accounts window.

Chart of Accounts window: The main goal of the Chart of Accounts window, is to add new accounts, view information about existing accounts and update different properties of existing accounts and update different properties of existing accounts.

Note that title appear in blue, normal Active Accounts in black, and accounts, that were entered in the G/L Account Determination window (default accounts) are displayed in green. Such as [301] Row materials.

We can change the properties for a single account using the Account Details button.

We can also add new G/L Account to an existing title. Let us create an [60*] Expense Account. I choose the Operating Costs drawer (Expenses) and select the expenditure title under which I want to create the account.

Choose the level 4 Utilities title. To add a new account I must switch to Add mode. I choose Data > Add (or Add icon from Tools bar). I enter new accounts details. Since I am at the level for Active Accounts, the radio button for Active Accounts is automatically checked.

Now we will look at the Edit Chart of Accounts window. We

choose:

Financials > Edit Chart of Accounts and choose Operating Costs. In this window

we can:

- Add a New title.

- Delete an account

- Change the structure of Chart of Accounts and move title accounts within the

structure of the Chart of Accounts.

I select an existing Level 4 title in the Operating costs section (choose the Level 4 Utilities title) and choose Add Same-Level Account. Other option is Add Sub-Level Account. I need to make sure that the Title radio button is selected. And I enter the [60*] Expense Account details. I need to make sure that the Title radio button is selected. And I enter the [60*] Expense Account details. I choose Update to save the title. Notice titles appear in blue.

Now, I will add a [60*] Expense

Account under the new title I have

just created. Although I could add an account in the Edit Chart of Accounts

window using the Add Sub-Level Account button. In that window I will have

additional options in creating the account. also, note that if you are using

account segmentation you must use the Chart of Accounts window to add accounts,

since you cannot add segmented accounts in the Edit Chart of Accounts window.

Administration > Setup > Financials >

Account Segmentation [US Localisation]

I choose Operating Costs / Expenses drawer. I select the Media expenditure title under which I want to create the account. I choose Data > Add. since I am on the bottom level, level 5, the Active Account radio button is automatically marked. I choose Add.

It is a good practice to have all your Active Accounts at the same level. In our example it is level 5.

We realize that the mobile phone would be more appropriately placed in the media category, so we move the account under the title Media below the Internet account. In the Edit Chart of Accounts window, I choose the account Mobile Phone. I choose the parent article for the title Media. This will move the Mobile Phone account underneath the internet account once I choose Update.

Let us look at how you can delete an unwanted account. Let us assume I made a mistake and created an account incorrectly, for example the Mobile Phone Account.

Note that you can only delete an account that has no posting.

I choose the account I wish to delete, the Mobile Phone Active Account.

I would

right-mouse click to see the context menu. I choose Advanced and then choose

Delete Account. At this point, I would choose Update if I actually wanted to

delete this account. However I do not actually want to delete the account, so I

choose Cancel.

Let us take a look at how the structure of the new accounts will appear in our Trial Balance report.

Financials > Financial Report > Financial an I choose the Trial Balance report.

I do not want see any Business Partners, so I deselect the Business Partner Box. I choose the Operating costs / Expenses drawer to see my new account structure. Since the new accounts do not have any balances yet, I deselect the Hide Acct with No Posting checkbox.

When the report first appears, we see only Level 1. I choose Level 5 (top left) to see my new title accounts. Here is the section for Utilities.

As you can see, the Chart of Accounts structure in SAP Business One affects the Financial Reports structure, in this case the Trial Balance report. Therefore, it is important to make sure you organize the chart of accounts by the levels and in the order appropriate to your preferred reporting structure.

Post a Journal Entry [Time: 33:10 min.]

Explain the ways to post Journal Entries in SAP Business One

Your are implementing SAP Business One at a new customer

The company accountant asks how she can record business transactions that do not have a document in SAP Business One.

In SAP Business One, a Journal Entry is automatically posted from many documents, such as A/R and A/P Invoices.

Additionally, you can manually post a Journal Entry directly G/L Account or to Business Partner subledger account.

All Journal Entries are posted to one file in SAP Business One - the Journal Entry file.

You can set defaults for Journal Entries. You can also change some document settings for an individual Journal Entry.

All Journal Entries refer to the type and number of original document, since frequently Journal Entries are created automatically from another document. For example, IN is used for customer invoices.

The origin documents of manual Journal Entries are the Journal Entries themselves. For this reason, they refer to themselves and are type Journal Entry (which is standard for Journal Entry).

Most Journal Entries refer to other document type (for example PU or AP invoices).

The screen for entering Journal Entries is divided into 3 areas:

- document header data,

- expanded editing mode for an item, and

- the items table.

You can show or hide the expanded editing mode. The mode always refers to the row that is currently selected and displays all the item fields for you enter the relevant data.

Using Form Settings, you can define which columns display in the line items table.

You can enter multiple lines which Debit or Credit amounts. In every line you add SAP Business One will recommend a balancing amount which you can update.

When entering manual Journal Entries, in each line, place the cursor in the G/L Acct / BP Code field and press Tab to display the accounts list, or Ctrl + Tab to display the Business Partner Master Data List. alternatively, you can search for an account or a Business Partner using the G/L Acct / BP Name field.

Users can make input errors. As a result, the Journal Entry created may

contain incorrect information. To provide an audit of the correction, the user

must first reverse the Journal Entry in error, and then capture the document correctly. You

can specify whether reversal transactions are performed:

- As standard reverse transactions or

- As reverse transactions with negative amounts.

The standard reverse transaction causes the system to post the Debit in error as a Credit and the Credit as a Debit. This corrects the balance of the accounts. However, the standard reverse transactions causes an additional increase in the totals on the Debit and Credit sides, which might be misleading.

The reverse transaction with negative amounts causes the system to post the Debit error as negative Debit and Credit errors as negative Credit. This not only corrects the balance of the accounts but also the totals.

It depends of the country whether standard reverse transactions or reverse transactions with negative amounts are required.

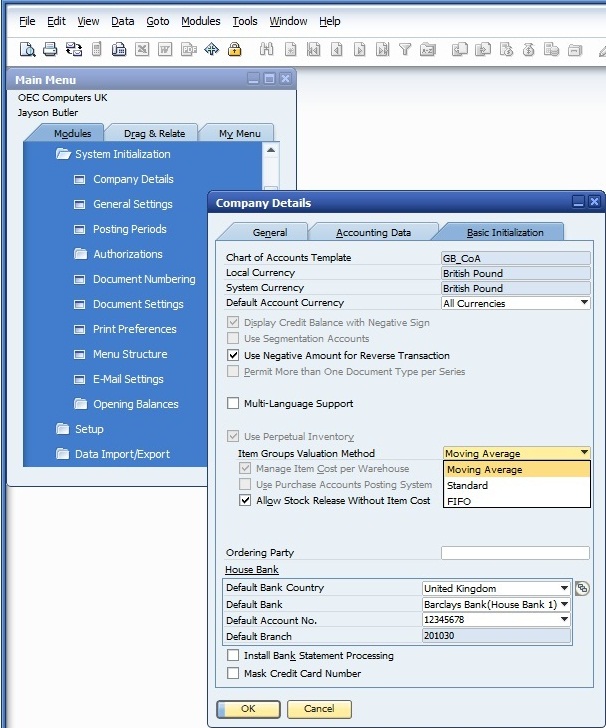

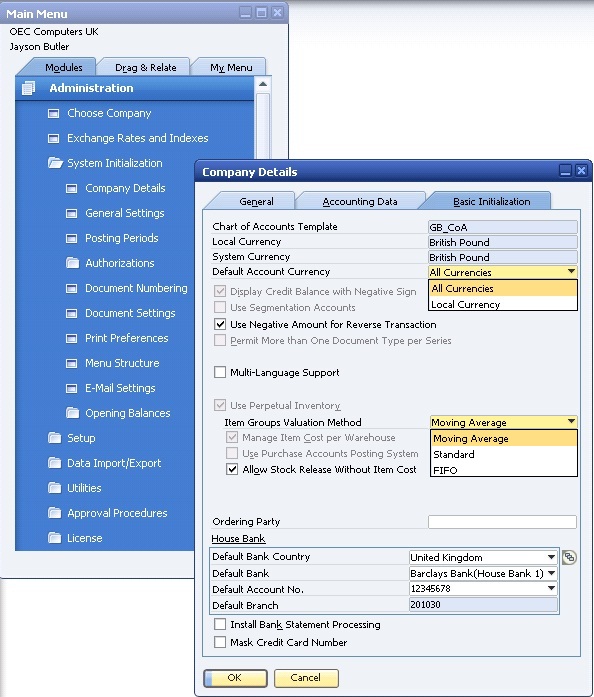

You can set which type of reverse transaction is used in the

Company Details:

Administration > System Initialization > Company Details > Basic Initialization:

Use Negative Amount for Reverse Transaction.

On the basic initialization tab, you can select the Use Negative Amount for Reverse Transaction field to switch on the reverse transaction with negative amounts. Otherwise, the system will use the standard reverse transaction. This setting is relevant for both automatic and manual Journal Entries.

You do not always need to create a manual Journal Entry to correct input errors.

In the sales and purchasing processes, most documents have a cancelling document which will automatically create the reversing Journal Entry. For example, you issue an A/R Credit Memo to cancel an A/R Invoice. This document will create a cancelling transaction automatically.

For manual Journal Entries - you locate the Journal Entry you wish to cancel and choose Cancel from Data Menu. In this session, we do not demo canceling documents. This topic is covered in the e-learning session for the Purchasing and Sales process.

In this demo we will review the Journal Entry file including automatic and manual Journal Entries.

Lets us look at automatic Journal Entries and demonstrate their structure.

Financials > Journal Entry window and browse to previous record. I browse back in the Journal Entry file to documents created automatically by Sales and Purchasing documents.

In the Origin field I see the type of document which created this Journal Entry. When I choose the linking arrow I open the origin document.

The Journal Entries screen is divided into 3 areas:

- document header data,

- extended editing mode for an item, and

- the items tables.

Header: In automatic Journal Entries created by the documents in SAP Business One, the fields are filed automatically from the document fields. In manual Journal Entries I set the values myself.

The system automatically enters a number in the document

header. This number is incremented with every transaction. I can define

numbering series for Journal Entries on the document Numbering screen, under

the:

Administration > System Initialization > Document Numbering.

The 3 dates in the header default to the current system date

but I can change them:

- Posting Date - This date determines the Posting Period, and therefore the

fiscal period for financial reporting. I can post an earlier or later date if

the Posting Period is Unlocked for posting.

- Due date - The date the transaction is due.

- Document date - The date used for tax reporting purpose.

I can use the Ref. 1 and Ref. 2 fields to enter references to associated actual documents.

I can also classify the document using a transaction code,

for example, as an actual / deferral document, depreciation document, or value

adjustment document for reporting purposes.

Administration > Setup > Financials > Transaction Code to maintain the

transaction codes. The system copies the description of the transaction code to

the Details field.

I can show or hide the expanded editing mode. The mode always refers to the row that is currently selected and displays all the item fields for me to enter the relevant data. The Ref. 1, Ref. 2, Project, and Details fields are usually filled with the content of the fields from the header area.

In this Journal Entries file I also record manual Journal Entries.

I I open the Journal Entry window from the Financials module it is already in the Add mode ready to entering a manual Journal Entry. To post a manual Journal Entry, I choose the Data menu and Add.

Like the automatic Journal Entry, the screen for entering

Journal Entries is divided

into 3 areas:

- document header data,

- extended editing mode for an item, and

- the items tables.

In the line, I place the cursor in the G/L Account / BP Code field and press Tab to display the Account list, or Ctrl +Tab to Display Business Partners Master Data list. Alternatively, I can search for an account or a Business Partner using the G/L Account / BP Name field.

After choosing the account or the Business Partner, I enter an amount in Debit or Credit. I enter 250 in Debit. I can enter multiple lines with Debit or Credit amounts.

In every line I add SAP Business One will recommend a balancing amount which I can update. Click Tab and choose the Bank Account in the second line and press Tab in the row fields to get 250 in Credit.

If I add data in the header area, for example if I add a remark, the it updates the lines with the header information.

Once the Journal Entry is completed and balanced I choose Add.

Using the Form Settings option, I can define which columns to show in the line items table. For example, I can show the Distribution Rule field if I want to allocate the amount from a row to Profit Center. Furthermore, I can store values in the settings that the system users as default values when I enter manual Journal Entries on the Document tab.

Form Settings > Document > General:

- Lock Posting Template

- Allow Unbalanced Transaction in FC

- Allow Multiple Currency Transactions

- Copy Posting date to Document Date

- Block dunning Letters

Administration > System Initialization > Document Settings and choose Journal Entry on the Per Document tab. Here I can define default settings for manual Journal Entries.

To cancel a manual Journal Entry - I locate the Journal Entry I wish to Cancel and Choose Cancel from Data menu. I approve the system message, enter any necessary changes and add the canceling Journal Entry. In the Remarks of the cancelling Journal Entry I have 'Reversal' and the number of the Journal Entry I cancelled.

Note that the Cancel option is not available for automatic Journal Entries. You must use a reversal document instead.

The reverse method will be the Standard one or the Negative

amount method as I defined it in the

Administration > System Initialization > Company Details window

> Basic Initialization, under the Use

Negative amount for Reverse Transaction field.

Let us look at some reports that show different aspects of

the Journal Entry file:

Financials > Financials Report > Accounting > Transactions Journal Report. The

Transaction Journal Report shows all the Journal Entries of a certain origin type in

chronological order, sorted by transaction number. From here, you can go

directly to the origin document for the posting.

Financials > Financials Report > Accounting > Document Journal. The document Journal report is a similar report. Here you can use more options to select and tailor the output.

Financials > Financials Report > Accounting > General Ledger. The General Ledger report provides a view of the selected General Ledger and Business Partner accounts and lists all line items that you have posted to the account.

You can post a Journal Entry by:

In the next two slides we will review two template types for posting a Journal Entry. Template with Percentages and Recurring Postings.

Posting Template with Percentages

You can create posting templates for Journal Entries that have a very similar structure. These templates can contain account numbers but you can also just specify an account description in a line item if you do not yet know which exact account will be used for this line item. Instead of fixed amounts, only percentages are entered here. These percentages indicate how the total amount is distributed among the line items. The illustration shows an example of how you can allocate a utility expense, like the electric bill, to its component expenses at a specific percentage rate. The posting template is stored under a code and with a description. Then, when you enter a Journal Entry manually, you can choose the Percentage template, enter an amount in one the line items and the template will allocate the amounts to the other lines based on the percentage rate you have defined.

SAP Business One features a recurring posting function for similar, fixed amount Journal Entries created on a regular basis. Recurring Postings use a template that is stored with a Code and a Description.

In his template, you define, among other things, the frequency in which the Journal Entry is supposed to be created and a validity date until the recurring posting is valid.

The system duplicates the original Recurring Posting (instance 0) every time the execution date arrives, and presents a report recommending you post the transactions that are due. Once you use this instance and add it to the system, it will be Deleted.

You can add Recurring Postings to the Cash Flow, which appear in green in the report.

Options for Recurring Postings

You have a few options when you set up a recurring posting. You can set the frequency for how often the posting will occur. You can choose a frequency from a frequency list. You can also set a validity date for the posting which specifies the last possible date a posting can be made.

If you do not whish to post on regular basis, you also have an option to set up a recurring posting as a template to be used as needed. You can create these recurring posting in advance. Set the status to "not executed yet" until you need to begin the postings. This status can also be used to turn off a recurring posting.

We will demonstrate the two template types: Template with Percentages and Recurring Postings.

Financials > Posting Templates to enter and maintain Posting Templates.

Here is a Post Template I have defined earlier. I use it to allocate out a utility expense, like the electric bill, to its component expenses at a specific percentage rate.

Note that the template contain account numbers but I can also just specify an account description in a line item if I do not yet know which exact account will be used for this line item.

Instead of fixed amounts, only percentages are entered here. These percentages indicate how the total amount is distributed among the line items.

Financials > Journal Entry. When I enter a Journal Entry manually, I choose Percentage in the Template Type field an enter the template code in the Template field or press tab and choose it from a list. According to the transaction I am now recording, I enter an amount in one of the line items and press Tab. The template will allocate the amounts to the other lines based on the percentage rate.

Financials > Recurring Postings to enter and maintain Recurring Postings. Here is a Recurring Posting I have defined earlier for rental amounts our company pays once month.

In this template I defined fixed amounts as well as the frequency in which the Journal Entry is supposed to be created and until when the Recurring Posting is valid. The possible entries in the Frequency field include: Daily, Weekly, Monthly, Quarterly, Half Year, Annually. I must also specify the next execution date for these entries.

One time: Although a one-time Recurring Posting seems a bit odd, it serves a

special purpose. with this I can schedule a Journal Entry for a specific date.

Template: Journal Entries that I need repeatedly but not a regular basis can be created as

this type. I can access these templates from the manual Journal Entry.

Not executed yet: If I do not need the Recurring Posting at present, I can turn it off with

this entry.

In the Valid To field, I can enter a date until which the Recurring Posting is valid and will be executed by the system.

Ho do I execute the Recurring Posting?

Financials > Recurring Posting. The I choose Confirmation List to display the postings for execution.

In the Confirmation of Recurring Posting window a list of all instances of Recurring Posting templates that are due until today appear. In the Confirmation of Recurring Posting window a list of all of all instances of Recurring Posting templates that are due until today appear. The system duplicates the original Recurring Posting (instance 0) every time the execution date arrives. I use this window to define which instances I want to save to the database and which can be removed form the list I select the Recurring Posting I just created. I choose Execute to post the entry and choose Add to the system message.

If I need to make an adjustment to the entry, I can use the navigation arrow to open the transactions instance, and make the change, before I post it to the Journal Entry file. Once I use this instance and add it to the system, it will be deleted.

I can also configure the system so that the execution list is displayed automatically in the execution date as soon as I log on.

Administration > System Initialization > General Settings > Service tab: Display Recurring Postings on Execution indicator to activate this service.

Note: I can also execute a Recurring Posting manually: in the Journal Entry window I display a list of all the Recurring Posting in the system. I choose a Recurring Posting instance; I can then adjust the posting and add it.

SAP Business One offers a two-stage procedure for creating Journal Entries. You create the Journal Entries as drafts first, correct and post them later. A user create entries in a JV. The JV is basically a folder for storing several Journal Entry drafts. You can save unbalanced Journal Entries in a JV as long the JV is in the draft mode. You can change JVs as long as they have not posted yet. You can acces the JV, make any necessary corrections, and post the entire JV.

You do not have to post each Journal Entry individually. If you do want to post Journal Entries individually, however, joy must create a separate JV for each Journal Entry draft.

You can remove JV or Delete an entry from JV, as long as they have not been posted yet.

We will demonstrate the process of creating a JV and reviewing it before posting as Journal Entries.

Financials > Journal Voucher. Next, I choose Add Entry to New Voucher. I enter a Journal Entry. In this example, I post a Debit for an expense to an Expenses account and Credit the same amount to my Bank account. To choose the [60*] Expense Account I type "te" in the G/L Acct / BP Name field, an then I press Tab. From the account list I choose the "Telephone" account. I choose Add to voucher.

The, I enter a second Journal Entry. I Debit the Bank account and Credit a vendor. I choose Add voucher. I Close the window.

Let us assume that I need to update one of the entries in the JVs screen.

I highlight the JV I have just created. I double-click the second transaction and change the Vendor in the JV entry. I double-click the second transaction and change the Vendor in the JV entry.

Note that I can duplicate a row in the JV, I can also quickly remove one of the rows, by right clicking it.

Next I post JV to the Journal Entries file. In the JVs window, I highlight the JV I have just updated and I choose Post Voucher. I choose Yes in the system message.

Let us check whether the postings have been made in the General Ledger.

I open the Journal Entry window. I choose Previous Record to display the second entry I posted to the JV. If I choose the link arrow in the Origin field I can view the Closed JV.

Internal reconsolidation [Time: 17:54 min.]

We discuss how to utilize the process of internal reconciliation, both system and user reconciliations, in G/L Accounts and Business Partner. You will learn how to review automatic and semi-automatic system reconciliations, and how to perform Internal Reconciliation manually.

Imagine that you are implementing SAP Business One at new customer. Maria, the accountant of company, asks you more about the Internal Reconciliation Process.

She remembers you told her previously, that among other processes, it relates to Period-End Closing: [...] Automatic system reconciliations ca be full or partial.

You give Maria two examples of full automatic reconciliations:

- First, in the Business Partners Master Data accounts when an Incoming Payment

is based on an A/R Invoice (or a Credit Memo on an A/R Invoice).

- Secondary, in

[581]

Clearing G/L Accounts when you Deposit a check received by an

Incoming Payment.

You tell Maria that SAP Business One also performs Partial Reconciliations if, for example, a customer partially pays an A/R Invoice.

However, these will be causes where Maria will perform Internal Reconciliations herself - these are the User Reconciliations. For example, when a company pays a Vendor in advance and receive the A/P Invoice later on, Maria will have to internally reconcile the Vendor Master Data and mach the Payment with the A/P Invoice transactions.

Just like with System Reconciliations, user reconciliations can be full or partial.

Reflection Question: Internal Reconciliation Process

The A/P Invoice should appear as closed for:

- The Outgoing Payment

- Reports as Aging and Doubtful debts.

Let us consider the case we have just discussed, where company pays a vendor in advance and receive the A/P Invoice lather on. When Maria looks at the vendor's account balance, it reflects the advanced Outgoing Payment and the A/P Invoice transactions.

The reason is that if reconciliation is not dome, the A/P Invoice will appear as open when creating a new Outgoing Payment for the Vendor.

Another reason is the effect on reports, such as Aging and Doubtful debts.

The A/P Invoice appear as open in those reports if Maria does not reconcile it with the Outgoing Payment transaction.

Internal Reconciliation Definition

The term, Internal reconciliation, refers to the matching and

clearing of open credit items top open debit items within an account (therefore

internal). This is necessary for accounts where a business process is not

regarded as fully complete until each credit amount has a corresponding debit

amount:

- For [411] Customer Accounts, a receivable (Debit) must be followed by an Incoming

Payment (Credit).

- For [401] Vendor Accounts, a liability (Credit) must be followed by an Outgoing

Payment (Debit).

As we mentioned before, the system can reconcile transactions either fully or partially.

System reconciliation takes place automatically. Let us discuss a few examples: When you apply a payment to an invoice, create a Credit Memo for an invoice or Cancel document, the original Journal Entry is reconciled with the reversal.

When you Deposit a check, the payment Journal Entry is reconciled with the Deposit for the [581] Clearing Account row. This means fir the most part, you do not have to maintain and conduct Internal Reconciliations in the system. As we mentioned before, the system can reconcile transactions either fully or partially.

System Reconciliation - Full Reconciliation

The system will attempt to automatically perform full reconciliation when you post a payment for a customer or vendor. The system matches the business rows in the Journal Entry of the payment with the invoice or invoices that you have selected and closes the transactions.

it will also close any selected Credit Memos and other transactions that were selected in the payment.

In the graphic we show how full system reconciliation occurs with an Outgoing Payment to a vendor. On the left we show the A/P Invoice with its Journal Entry. On the right we see the Outgoing Payment for the invoice. When the invoice is paid, the system automatically performs internal reconciliation in the vendor master record.

In this example, we shows only one invoice, but the payment could have paid 2 or more invoices and the automatic reconciliation would still have been performed.

For payments made with the Payment Wizard or Bank Statement Processing, the system automatically proposes (and sometimes automatically matches) payments with invoices or Credit Memos based on criteria that you supply, such as due date and amount.

System Reconciliation - Partial Reconciliation

It is possible to partially reconcile transactions when issuing incoming or Outgoing Payments. Partial reconciliation is done when a payment amount does not match the amount of the selected transactions.

For example, a customer may pay a partial amount due. When a partial payment is made, the system adjusts the Balance Due appropriately and partially reconciles the invoice. When the remaining balance on the invoice is paid the invoice will be fully reconciled and the Balance Due will become zero.

Now we look at both full and partial reconciliations. In this demo we will review the automatic reconciliation created in SAP Business One while issuing a payment based on invoices. I will demonstrate a full and partial reconciliation.

I have just received a payment from one of our customers:

Banking > Incoming Payments > Incoming Payments and create an Incoming Payment.

The customer

fully pays 2 A/R Invoices that are due. 2 days later the customer sends me

another payment. This time the customer pays of the A/R Invoice total amount. I

choose the invoice and change Total Payment amount in the invoice row to XXX.

This is a partial payment.

Now let us look at the reconciliation created in SAP Business One. In browse to the customer Master Data and open the [411] Customer Account Balance using the linking arrow.

We see that 2 A/R Invoices and the first Incoming Payment do not appear. Why is that? This is because they were automatically reconciled. The 2 invoices on the debit side against the Incoming Payment on the credit side [and Display Unreconciled Trans. Only is checked]. And why is the second Incoming Payment that was allocated to the third invoice does not appear? That is because it was fully closed on the credit side. The third A/R Invoice appears because it was partially reconciled on the Debit side.

In the Credit/Debit amount field of the transaction we see the full invoice amount. The Balance Due amount reflects the remaining Debit amount to be paid by the customer.

When I un-check the Display Unreconciled Trans. box, the first 2 A/R Invoices and the 2 Incoming payments appear too, but with a zero Balance Due amount.

User Reconciliation - Manual Type

A customer pays you but you forget to select the invoice when processing the payment. In that case, a payment is made on account rather than against a particular invoice. If the payment was posted as a Payment on Account, because no invoices were selected, the payment and the invoices stay open (and therefore unreconciled). Another example of payment on account might be where you have an agreement for a customer to pay a set amount each month regardless of the actual invoice amounts. Once again, because no invoice are selected, the invoices are unreconciled.

In these cases you need to reconcile the account with the Reconciliation function - as a User Reconciliation.

User Reconciliation: G/L Account

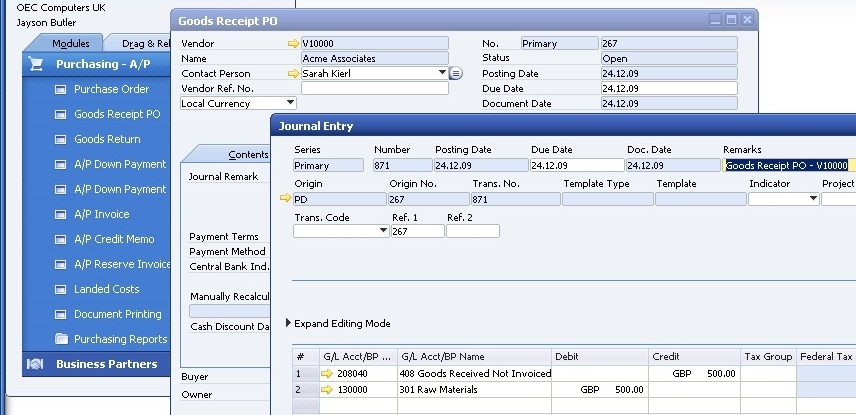

Allocation account: Good Receipt PO Credited > A/P Invoice Debited.

You can also perform user reconciliation in a G/L Account. If you company users the Perpetual Inventory system you usually reconcile the Allocation account. Remember an Allocation account is credited when you issue a Good Receipt PO and Debited in an A/P Invoice.

You can perform user reconciliation in this account.

User reconciliation types:

- Manual

- Automatic

- Semi-automatic

Manual is useful when working with a small number of transactions or cases where partial reconciliations are required or where transactions are posted to more than one Business Partner.

Automatic is used to reconcile a large amount of transactions, or a range of Business Partners, based on user defined parameters and priorities.

Semi-automatic is used to manually reconcile transactions, based on recommendations provided by SAP Business One.

Unique identifier for Internal Reconciliations:

The system assign a unique reconciliation number to each completed Internal Reconciliation (whether it is manual, automatic, or semi-automatic). The system also saves and assigns a unique number to system reconciliations, for example, reconciliations during payment processing.

Manage Previous Reconciliations

The Manage Previous Reconciliations function allows you to review or Cancel a user reconciliation.

Demo - User Reconciliation - Manual Type

Now we look at how to do a manual type user reconciliation. In this demo we will review the user reconciliation process. I will show you how to manually reconcile the transactions in the Business Partner Account.

Let us imagine that a customer paid us on account according to

an agrement we have and that I posted the invoice a month later when the actual

deal happend. Both the invoice and the Incoming Payment transactions stay open

and I need to reconcile them. To perform an Internal Reconciliation for the

Business Partner, I choose:

Business Partner > Internal Reconciliations > Reconciliations.

Note: I can also access Internal Reconciliation from the Account Balance in the Business Partner Master Data.

When I internally reconcile a Business Partner or G/L Account, I choose the reconciliation type: Manual, Automatic and Semi-Automatic.

Automatic is used to reconcile a large amount of transactions, or a range of Business Partners, based on user defined parameters and priorities.

Semi-Automatic is also typically used to reconcile a large amount of transactions; however the user needs to manually confirm the recommendations provided by SAP Business One.

In our example I choose the Manual reconciliation type. I can

conduct manual reconciliation for Multiple BPs, by checking the

Multiple BPs box.

This is useful especially in cases where I have a customer, that is also a

vendor, and I would like to reconcile A/R Invoices with the A/P Invoices of that

Business Partner.

In this case, I choose our customer and then Reconcile. The system displays all transactions for the account that are open on the current date. If desired, I can change the date to see open transactions for a different date. In manually select matching Debits and Credits. In this case I choose the open A/R Invoice and Incoming payment.

When the total of all the Credit items selected for reconciliation by choosing Reconcile. If the total of the selected Credit items does not match that of the Debit items, I can either: Partially reconcile one of the transactions by changing the Amount to Reconcile for the transaction or I can create a Journal Entry to post the difference as an adjustment that results in the selected transactions becoming reconciled. Our 2 transactions match so we choose Reconcile.

Note: To perform an Internal Reconciliation for G/L Account,

choose:

Financials > Internal Reconciliations > Reconciliation.

Let us assume that the reconciliation we have just added was

wrong. To Cancel a user reconciliation for a Business Partner, I choose:

Business Partners > Internal Reconciliations > Manage Previous Reconciliations,

allows you to review or Cancel a user reconciliation.

You can select reconciliations by account, reconciliation date, and reconciliation number, and then Cancel them individually. I choose the Business Partner Code in the Form and To fields and choose OK.

In the Reconciliation History table at the top I choose the reconciliation to be cancelled. I can review the reconciliation details at the bottom and then I choose Cancel Reconciliation.

Note that in this window I can review system reconciliation but I cannot Cancel them. Also note that this function does not allow you to reverse reconciliation Journal Entries. The postings still exist even though the reconciliation has been Canceled.

If you want to reverse these postings, you must reverse them in the general ledger in the usual way by choosing Data > Cancel in the Journal entry display.

Financial Reports [Time: 13:53 min.]

You review the Financial Reports with Maria the company accountant:

Note that the company usually gets last year's related documents after the end of the financial year or period. Therefore, they also issue the reports for the Closing Period, during the following period.

Balance Sheet:

- Fixed Assets: 10.04%

- Current Assets: 89.96%

Total Assets: 100%

From a financial controller's point of view where is most of the money invested?

At the end of the year you issue the Balance sheet report. You present the report in a summarized form.

For the Assets Drawer you see the following result.

Let us go back and examine the Chart of Accounts Structure in association with Financial Reports. This subject is discussed in the Manage the Chart of Accounts topic.

Although the Chart of Accounts will way according to a company's localization, the structure are very similar around the world.

Remember how in the General Ledger you distinguish between Balance sheet Accounts and Income Statement Accounts, which are also called Profit and Loss Accounts?

Influence on Financial Reports

The different reports run on the account balances relevant to a selected date or date range and the reports present them according to their drawer, level or type. For example, the Balance Sheet report is based on the Balance Sheet accounts and similarly the Profit and Loss statement is based on Profit and Loss accounts. The Trial Balance shows all the accounts types. All these reports are typically issued for the last day of each financial year or period.

Presents the financial position of a business, the company's value

| Dates | Up to a certain date |

| Drawers | All Balance Sheet

Accounts: Assets, Liabilities, and owner's Equity accounts |

| Calculation | Total Assets =

Total Liabilities + Equity Also: Relative percentage of each balance in the company's assets, liabilities, and equity set. |

| Example of documents and accounts affecting the report |

A/R Invoice -

[411] Accounts receivables, Sales tax account. Outgoing Payment - Bank account Good Receipt PO - Inventory account |

Dates: You run the Balance Sheet up to a certain date, that is from the beginning of the company until that date.

Drawers: The Balance Sheet presents all Balance Sheet Accounts: Assets, Liabilities, and owner's Equity.

Calculation: When you issue the report, the system runs the report on the account balances of the Balance sheet accounts and summarizes their values according to the formula: Total Assets equals Total Liabilities plus Equity. In addition, the relative percentage of each balance in the company's assets, liabilities, and equity is presented. The Equity section includes the profit period. This amount is calculated while the report is being composed, to represent the summary of the Profit and Loss of the period.

Example: Some examples of documents and their related accounts which affect the report. [411] Accounts receivable and the Sales tax accounts in an A/R Invoice. The bank Account in an Outgoing Payment. The Inventory account in a Goods Receipt PO.

Financials > Financials Report > Financials > Balance Sheet. In the 'T' field, I choose the end period date of the previous period.

Note that there is no 'From' field as the Balance Sheet accounts accumulate the company's value from day one.

I can choose to 'Add Closing Balances' to include period end Closing transactions in the report.

Each first-level title, that is a drawer, equal 100% - Assets, Liabilities, and owner's equity, seen here as capital and Reserves.

When I drill down to a lower account level I see the titles and the active G/L Account displayed with their relative percentage in the drawer. I choose level 5 to see the most detail.

Note that the accounts appear according to their order in the Chart of Accounts, for example Bank Account.

At the bottom of the Report, under the Equity section, I can find the Profit for the Period selected. This is not a specific account, rather, it is a calculation done while composing the report.

A summary of all accounts and / or Business Partner balances. Can comprise a particular cross section

The Trial Balance displays a summary of all accounts and / or Business Partner balances. The report can comprise a particular cross section of accounts and Business Partners.

Dates: You can issue the report for a selected Posting Period or periods.

Drawers: The Trial Balance presents all selected accounts (Balance Sheet and Profit and Loss) and Business Partners Master Data.

If you include Business Partners in the report, those will be shown at the end, after the list of accounts. The total balance for customers and vendors is represented in the list of accounts, through the control accounts balances.

Calculation: When you issue the report, for each account the system presents the total Debit and Credit amounts, and the ending balance which is calculated as the Debit amount minus the Credit amount. For the entire report: if the Trial Balance includes all the accounts in a complete period, the Debit and Credit side totals must be equal. That is, the total report balance should be zero.

Example: Here is an example of a document and its related accounts which affect the Trial Balance report. An A/P Invoice includes: the Vendor, the Account Payable account, a [581] Clearing Account or an Inventory account, and the Output Tax account.

Now we will tun the Trial Balance for all our accounts and out Business Partners.

The Trial Balance can comprise all accounts (Balance Sheet and Profit and Loss) and all Business Partners Master Data. Or, you can run it a particular cross section of accounts and Business Partners.

Financials > Financials Reports > Financials > Trial Balance. In our example I choose all accounts and Business Partners by choosing the Select all button at the bottom.

I can issue the report for a selected Posting Period or periods. I will tun the report the previous fiscal year. I can choose whether to include the opening balance for each account in the report.

The Trial Balance displays a summary of all accounts and Business Partner Balances.

In Assets we see the totals for A/R receivables listed under trade debits. And here are the totals for our Trade Creditors.

In Liabilities we see the totals for A/P payables.

We scroll down the bottom of the report to see a list of Business Partners with their individual Business Partner account balances.

For each account the system presents the total Debit and Credit amounts, and the ending balance which is calculated as the Debit amount minus the Credit amount plus opening balance amount if you choose to present it on the report.

Note that the balances are already included in the total amount of the report, using A/R and A/P control accounts.

Shows the Profit (or Loss) of your business for the fiscal year / selected period, and explains the change in the company's value

| Dates | Selected period |

| Drawers / Type | all Profit and

Loss Accounts: The last 5 drawers: Revenues, Cost of Sales, Expenses, Financing, and Other Revenues and Expenses |

| Calculation | The balances of the [60*] Expense accounts will be subtracted from the balances of the Revenue accounts to come up with the Profit or Loss for the fiscal year / selected period. |

| Example of documents and accounts affecting the report |

A/R Invoice -

Income account. A/P Invoice - [60*] Expense account |

The Profit and Loss Statement shows the Profit (or Loss) of your business for the fiscal year or the selected period.

It explains the change in the company's value.

Dates: You run the report for a selected period.

Drawers: The Profit and Loss Statement presents all the accounts located in the 5 Profit and Loss drawers: Revenues, Cost of Sales, Expenses, Financing and the Other Revenues and Expenses.

Calculation: When you run the report, the system calculates the Profit and Loss for the fiscal year or the selected period according to this calculation: The balances of the [60*] Expense Accounts will be subtracted from the balances of the Revenue accounts.

Example: and here are some examples of documents and their related accounts which affect the report: The income account in an A/R Invoice. and the [60*] Expense Account in an A/P Invoice.

Now we will run the Profit and Loss report.

Financials > Financial Reports > Financials > Profit and Loss Statement.

The Profit and Loss Statement shows the Profit (or Loss) of your business for the fiscal Year or selected period. Therefore, it does not include any opening balance. The report presents all Profit and Loss Accounts in the last 5 drawers.

The balances of the [60*] Expense Accounts are subtracted from the balances of the Revenue account and result in the Profit for the Period.

The balance Sheet calculation is: Total Liabilities + Equity

How is the calculation balanced if the report considers only the Balance Sheet accounts?

Here is a question for those of you with accounting backgrounds: The Balance Sheet calculation is: Total Assets equals Total Liabilities plus Equity.

How is the calculation balanced if the report considers only Balance Sheet accounts?

The Profit or Loss Accumulator is included in the Balance Sheet report and will either increase of decrease the Equity on the Balance Sheet.

Company Analysis and Planning [Time: 26:52 min.]

In previous year Company entered the fiscal year with higher expenses than expected:

Imagine that you are implementing SAP Business One at new company.

Maria, the accountant, says that in previous years company ended the fiscal year with much higher expenses than expected.

Note that you need to make decisions about Budget, Projects, and Cost Accounting definitions together with the client accountant.

The Budget module helps you manage and track company expense.

You can block the creation of transactions for G/L accounts that exceed their budget limit

The Budget module helps you manage and track company expenses.

The purpose of budgeting is to provide a forecast of expenditures, in other words, to construct a model of how a business might perform if certain strategies, events and plans are to be carried out. This way, the actual financial operation of the business can be measured against the forecast.

In SAP Business One, a budget is based on the data your enter, which specifies the maximum amount that can be allocated to a particular G/L Account on a monthly or annual basis.

In the course of daily routine, the application checks the debit side of G/L Accounts for which a budget has been defined.

If the Budget is exceeded, the application either issues a warning or blocks the action, depending on the chosen setting.

Note that the budget functionality works with calendar months only.

Steps to activate the Budget functionality:Let us review the steps you need to take in order to activate the budget functionality:

If you decided to manage your budget on a monthly basis, you can define Budget Distribution Methods.

Note that Budget distribution Methods are not relevant for working with an annual budget.

3. Budget scenarios are used mainly for displaying budget reports.

Using as scenario, you create a prognosis of a particular situation for the company's Budget and obtain important information about what the budgetary balance would be according to the selected scenario. For example: an optimistic scenario versus a pessimistic scenario.

The supplement budget scenarios can be based on a scenario with an initial ratio.

When you set up new company, the application provides a default scenario called Main Budget. This scenario cannot be altered.

Remember, this scenarios are only for budget reports.

In the course of routine work, deviation from the Budget is checked against the Main Budget only.

4. Define Budget

amounts

5. Performa an analysis by

comparing the defined budget with actual business activity.

After you have defined Budget scenarios, it is now time to define Budget amounts.

You specify the maximum amount that can be allocated to a particular G/L Account.

The actual financial operation of the business can be measured against the forecast.

Budget amounts can be copied from a previous fiscal year or imported from a different company database with the same G/L Accounts.

Once the Budget is defined for the selected accounts, you are able to perform an analysis by comparing the defined budget with the actual business activity.

An automatic check for deviation from the Main Budget scenario is executed, and if the Budget is exceeded, an alert is issued.

You can define authorizations for users to confirm budget deviation.

Budget Report analyzes the business activities that occur during a defined period with reference to a selected budget scenario.

Company Budget Reports: The standard company reports can be displayed with the budget data

Run the Budget reports according to a preferred Budget scenario

In the course of routine work, when you create a transaction against an expense G/L Account which is Relevant to Budget, a check for deviation from the Main Budget scenario is executed, and if the budget is executed, and if the Budget is executed, an alert is issued.

Administration > System Initialization > General Settings > Budget, there is a Budget clause in which you can define authorization for users to confirm Budget deviation in case a G/L Account exceeds the Budget and an alert is displayed.

The Budget Report enables you to display the company's Budget data according to your requirements.

The first step in the process is Budget Initialization

Administration > System Initialization > General Settings > Budget: Budget Initialization checkbox. When I update, I have the option to Mark all P & L accounts as Budget accounts. I choose Yes. As a result the Relevant to Budget checkbox is selected in all your Profit & Loss G/L Accounts.

Financials > Chart of Accounts > Account Details pushbutton. I can also manually select non Profit & Loss G/L Account to be relevant to the Budget by selecting the Relevant to Budget checkbox for each G/L Account.

Next, I define the system reaction for a document that deviates from the Budget definition: I choose "Warning". Also "For Annual Budget" and I choose all 3 levels: Purchase Order, Good Receipt PO and Accounting. If the Purchase Order, Goods Receipt POs, and Accounting checkboxes are selected, the application performs a check for deviation from the Budget during the generation of Purchase Orders, Good Receipt POs, and A/P Invoices and Journal Entries.

I can skip step 2: Define Budget distribution Methods, since budget distribution methods are not relevant for an annual budget.

Financials > Budget Setup > Budget Scenarios and define 2 Budget scenarios: I choose Data > Add Row (Ctrl + I). The first row is the Main Budget by default and I cannot change it. I choose Update. Then I can add another row. The second row will be an 'optimistic scenario' based on the main scenario with 110% of initial ratio. I enter Optimistic Scenario, choose Main Budget as the base and set the ratio to 110%. Then Update.

After I have defined Budget scenarios, it is now time to define Budget amounts.

Financials > Budget setup > Budget: Main Scenario and OK

At the top of the window, we see the title shows Main Scenario and the fiscal year is displayed. At first no accounts appear because there is nothing budgeted yet. I choose Display accounts with no budget to display all my accounts.

In the Debit column I define Budget amounts for 3 [60*] Expense Accounts.

Budget can be initialized at any point in time even if you already used the system for some time. In this case, you have an option to define budget amounts form this point going forward or define you total annual amount. The system asks me "Has transactions in system?" When I answer Yes, the system includes the actual so far. [The Debit amount is automatically copy to Actual].

Note that you can define Budget amounts only for G/L Accounts which are defined as Relevant to Budget in the Chart of Accounts.

Also note that SAP Business One checks the Budget for deviations against the Debit side. Thus, alerts are only triggered for accounts with a Budgeted amount in the Debit column.

You can use the Credit field for Sales Accounts to set revenue targets which you can track with Budget Report.

Now I will enter a Service A/P Invoice. Remember we selected a warning to occur if we exceed the budget when adding an A/P Invoice. Then choose one the [60*] Expense Accounts for which I have entered Budget amounts in the previous step. I see the Budget deviation alert as I choose an account which is Relevant to Budget. A check for deviation from the Main Budget scenario was executed, and because the budget is exceeded, an alert is issued. "Amount exceeds Annual budget for account 610034". As I have permission to approve Budget alerts I can proceed adding the A/P Invoice.

Administration > System Initialization > Authorization > General Authorizations: Financials > Budget setup, there is clause in which I can define Authorization for users to confirm Budget deviation in case a G/L Account exceeds the Budget and an alert is displayed.

Financials > Financials Report > Budget Reports > Budget Reports. I choose the main scenario, and the current fiscal year. I have the option to include any "Future Balances". This means the system will consider Open Purchase Orders and Goods Receipt POs. I choose only Operating Costs. Then I run the report (Execute). I choose level 5 displays the total for each account. Here, I can see the actual costs and the future costs for each account. I can see the remaining balance of the budget. On the right, I can see deviations from the defined Budget amounts. I can also view the difference in percentages.

The standard report company reports can also be displayed

along with the Budget data in:

Reports > Financials > Budget Reports: Balance Sheet, Trial Balance and Profit &

Loss statement.

Cost Accounting: Business Example

Imagine your company is divided to departments:

How can you issue a Profit and Loss report for department?

In this example, the Sales department brings in more revenues than the other departments. They also have a lot of expenses: travel, hotel, dinner, conferences, advertising, bonuses etc.

As the accountant of the company, how could you know the bottom line for each department?

How can you issue a Profit and Loss report for a department?

To use the const accounting functions in SAP Business One, you must define the Cost Centers of departments in your company as Profit centers. You can then compile a Profit and Loss statement for each Profit center in every period.

You can combine your Profit centers into groups by using a sort code.

The system automatically creates a Center zero profit center (Center_z) that collects the costs and revenues that cannot be clearly to another Profit centers because not enough information is available. The Center_z profit center can also record costs that are not to be reported in internal cost accounting.

For example, if you to show only 80% of your rental expenses as costs, you can assign the remaining 20% to Center_z.

The Center_z is used then defining distribution rules.

Distribution rules define how the costs or revenues posted to an account are distributed to the Profit centers.

When you create a profit center, the system automatically creates a distribution rule with the same name. This rule (which cannot be changed) is configured so that the system posts all the costs ore revenues to the relevant center. You can use these distribution rules for direct costs and revenues, which you can assign uniquely and in full to a specific Profit center.

For example, in OEC Computers, company car expenses are assigned directly to the "service" Profit center since only technicians hold a company car.

You allocate indirect costs and revenues to one or more Profit centers using a distribution rule. In the distribution rule, you specify how the amount is to be allocates amongst the Profit centers.

You can allocate by percentage or ratio, for example, you can distribute heating costs to the Profit centers in accordance with the size of the heated areas. Similarly, you can distribute voluntary employee benefits among the number of employees.

Link Between General Ledger and Cost Accounting

For costs to be included in Cost Accounting, you can either:

- Include a distribution rule in a Journal Entry row or a Marketing document row

or

- Post a Journal Entry or Marketing document to a G/L Account that linked to a

distribution rule.

You can only link accounts with the account type Sales or Expenditure in the Chart of Accounts.

You can use the Profit Center report to display an overview of the posted costs and Revenues.

You can produce some standard reports for a specific Profit center, for example, Profit and Loss statement, Trial Balance, and Budget Report.

Demo - working with Cost Accounting

Let us take a look at how you can work with Cost Accounting.

To use the Cost Accounting functions in SAP Business One, I must first define the Cost centers of Departments in the company as Profit centers. I can then compile a Profit and Loss statement for each Profit center in every period.

Financials > Cost Accounting > Profit Centers.

In this company I have already defined 2 Profit centers, for the HR and IT

Departments. I have given them the same sort code ADM so that they will appear

together in reports.

Let us define a new Profit center for the marketing department (switch to Add mode). I enter a profit center code: MKT and Name: Marketing. I choose Add.

The system automatically creates a zero Profit center - Center_z. Its collects the costs and Revenues that cannot be clearly distributed to other profit center. The Center Z is used when defining distribution rules.

I use distribution Rules in order to define how to costs or Revenues posted for an account are distributed to Profit centers.

Financials > Cost Accounting > Distribution Rules. When I create a profit center, the system automatically creates a distribution rule with the same name. I use these distribution rules for direct costs and Revenues, which I can assign uniquely and in full to a specific Profit center.

Note that the Direct Debit box is checked and the entire value is allocated to the relevant Profit center. I allocate indirect costs and Revenues to one or more Profit Centers using a distribution rule which I define. In this distribution rule, I specify now the amount is allocated amongst the Profit centers. Let us define a distribution rule to allocate electricity costs to Profit centers.

I switch to Add mode and enter a code: ElectCo and description: Electricity Costs. In the Total field I enter '150' to be used as the factor for the departments total space. In the table I enter the Cost center codes and their values. In the first row I enter the Center Code HR with a value of 20. Then, in the second row I enter the Center Code IT with value of 70 and the Center Code MKT I enter a value of 60.

IN case I cannot define the total allocation, for example if I do not have enough information about the Marketing cost center, the system allocates the unassigned costs or Revenues to the Center_z profit center. When I will have the information I need, I can change the distribution rule so that the system corrects the distribution accordingly.

Now, when the factor value is allocated, I choose Add to add the electricity costs distribution rule.

Financials > Cost Accounting > Table of Profit Centers and

Distribution Rules to display the Allocations for distribution rules.

To automate the Allocation of Revenues and expenses to the Cost centers in every

day work, I link the relevant accounts to a Distribution rule.

Financials > Chart of Accounts. I choose a suitable [60*] Expense Account. I check the Distribution Rule fox and choose the Electricity Costs distribution rule from the drop-down list. I save the settings by choosing Update.

Note that you can only link accounts with the account type Sales or Expenditure in the Chart of Accounts.

Now, whenever I post a Journal Entry or Marketing document to the Electric Company account the amount will be allocated the 3 Cost centers according to the Electricity Costs distribution rule.

Let us see an example.

Purchasing - A/P > A/P Invoice. I choose the Vendor 290000. I change the A/P

Invoice type to Service. I enter a Posting Date. I select Electricity

[605] Account

that I have linked to the electricity Costs distribution rule. I enter 200 as

the amount and Add the invoice.

Another way to allocate Revenues and Expenses to the Profit centers is to include a distribution rule in a Journal Entry row or marketing document row.

You can add the column by using Form Settings.

I can use the Profit Center report to display an overview of the posted costs and Revenues.

Financials > Cost Accounting > Profit Center Report. The Expenses column shows cost distribution based on the distribution rule. I can also produce some standard reports for a specific Profit center, for example, Profit and Loss Statement, Trial Balance, Budget Report.

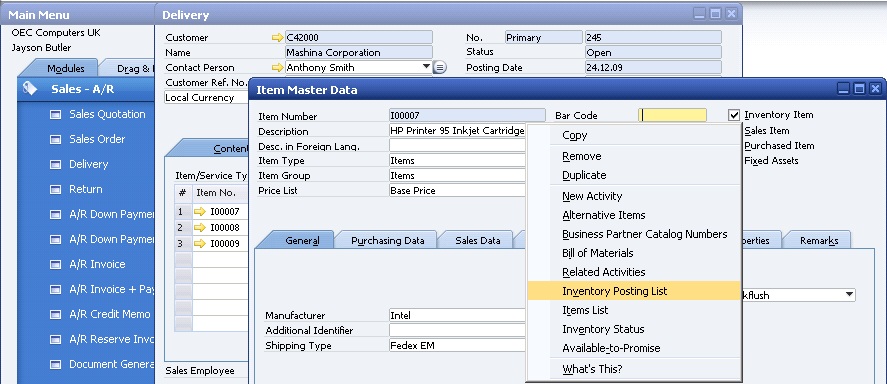

You can use projects in SAP Business One to monitor your company's larger key projects and their economic succes. To do so, you first define projects in the system.

You can then enter these directly in the relevant line items or the Journal Entry or Marketing document.

You can also enter Projects in General Ledger accounts or Business Partners. The relevant Projects is then automatically entered in the documents you post to these accounts.

The Transaction Report by Projects lists all postings that you have made for a selected project. You can produce many standard reports for a specific project, for example, Profit and Loss Statement, Trial Balance, and Budget Report.

Accounting for Sales and Purchasing [Time: 28:18 min.]

We will cover some general accounting conventions and give examples of the automatic Journal Entries that are created during the sales, purchasing, and inventory processes.

We will also talk about some financial settings that affect these automatic Journal Entries.

You are implementing SAP Business One at a new customer:

Every business transactions is recorded in the company's books. This allows you: To manage your company effectively with the option of Producing financial reports and To report the business transactions to the authorities.

Every business transaction results with a value exchange: A certain account increases value and another decreases value, resulting in the recording of balancing Debit side and Credit side postings.

Automatic Journal Entries: Reflection Question

Sales Quotation > Sales Order > Delivery > A/R Invoice > Incoming payment > Deposit.

In previous topics we learned about the documents in the sales process and their consequences on bookkeeping.

To review this process let us try to answer the following

question:

In a standard sales process which documents affect the accounting system?

Automatic Journal Entries: Answer

These are the documents in the sales process that create automatic

Journal

Entries and hence affect the accounting system:

- Delivery (only for Perpetual Inventory)

- A/R Invoice

- Incoming Payment

- Deposit (only for Perpetual Inventory)

Sales Quotation > Sales Order > Delivery > A/R Invoice

In SAP Business One, a Journal Entry is automatically posted for many documents during the sales, purchasing and inventory processes.

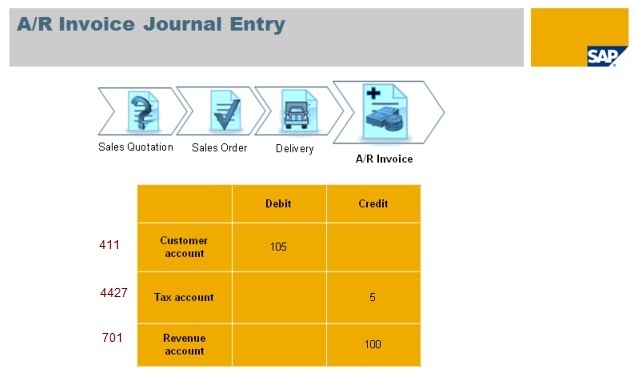

Now let us assume for a moment that we are in a non-Perpetual Inventory system in order to keep our example simple. In that case, in our sales process example, the A/R Invoice automatically creates the following Journal Entry: These is a Debit to the [411] Customer Account for the total price of the sale. There is a credit to the tax account for sales tax and a Credit to the Revenue account for the sales price (excluding tax).

Debit Credit

Customer account [411] 105

Tax account [4427]

5

Revenue account [701]

100

Let us focus on Debit side. Each transaction registered for the Customer affects the [411] Customer Account balances.

The account balances represents the difference between the total Debit transactions and the Total Credit transactions recorded for that account.

The transaction summary or the balance of a certain G/L account or Business Partner is the initial information the accounting system can provide about the business.

Previously, we mentioned that in each Journal Entry a certain account increases value and another decreases value, resulting in the recording of balancing Debit side and Credit side postings.

The effect on the account balance:

Assets, Expenses, and Drawings accounts are generally in Debit.

Liability, Revenue, and Capital (Equity) accounts are generally in Credit.

Here, we see the typical account balance of the different account types. For example, let us look at the value exchange for assets liabilities.

------------

... in non-Perpetual Inventory system ... the A/R Invoice automatically creates

the following Journal Entry:

There is a Debit to the Customer Account [14000 / 411

Trade Debtors (domestic)] for the total price of the sale (total

invoice value).

There is a Credit to the Revenue Account [400000 / 701

Sales Revenue (Domestic) - Product No.1] for the sales price (excluding tax) and

a Credit to the Tax account for sales tax [207000 / 4427

VAT Payable (output Tax)].

Each transaction registered for the customer affects the [411] Customer Account balance.

The account balance represents the difference between the total debit transactions and the total credit trasactions recorded for that account.

Assets, Expenses, and Drawings account are generally in Debit.

Liability, Revenue, and Capital (Equity) accounts are generally in Credit.

-------------

For Assets:

Debit transactions always increase the asset value.

Credit transactions always decrease the asset value.

For Liabilities:

Credit transactions always increase the liability.

Debit transactions always decrease the liability.

In a typical A/R Invoice, what is the effect of the Debit and Credit amounts on the involved account balances?

Debit Credit

Customer account [411] 440

Revenue account [701]

440

The two accounts increase their values.

The [411] Customer Account is considered an asset so any Debit to this account

increases the account value.

A credit to the Revenue Account, as we saw on the previous slide, increases the

account's value.

In the Journal Entries that automatically posted by documents in SAP Business

One, how does the system "know" witch accounts to use?

The system knows which accounts to use because when you initialize SAP Business

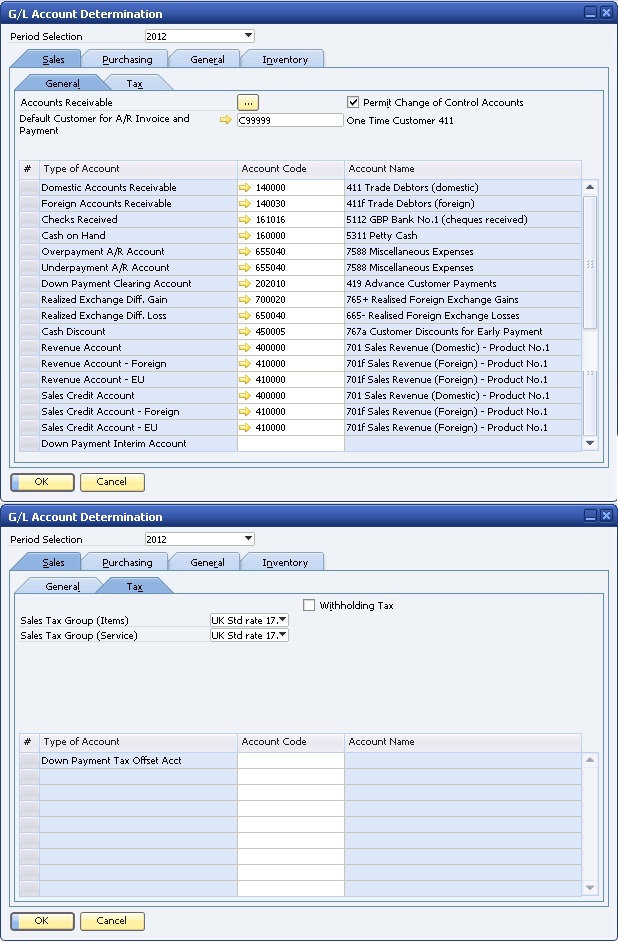

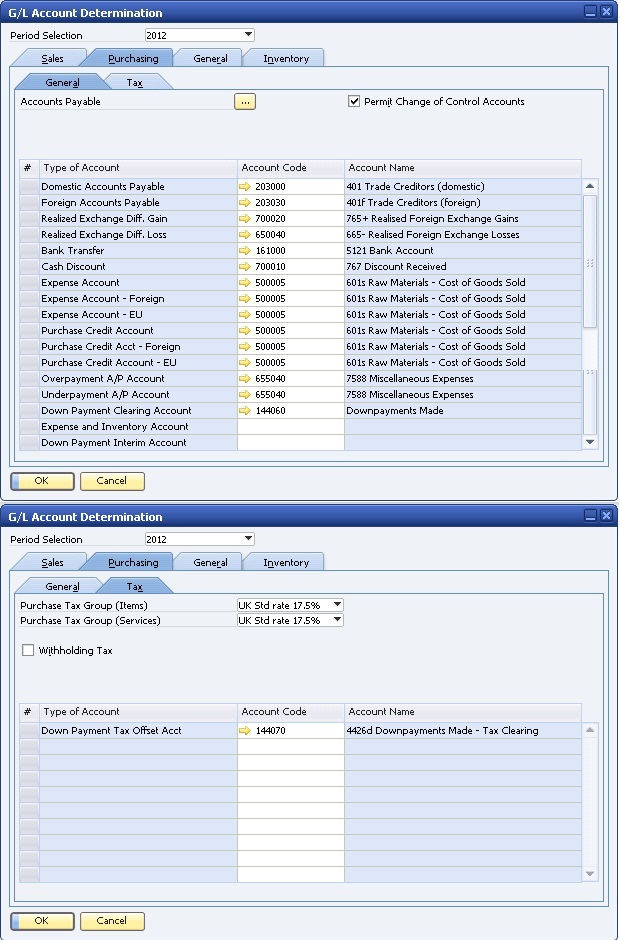

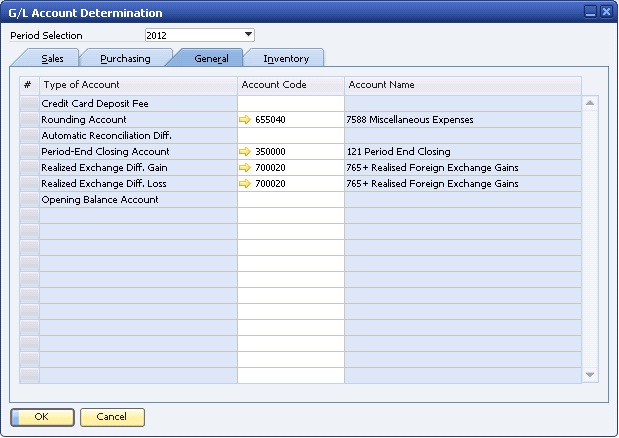

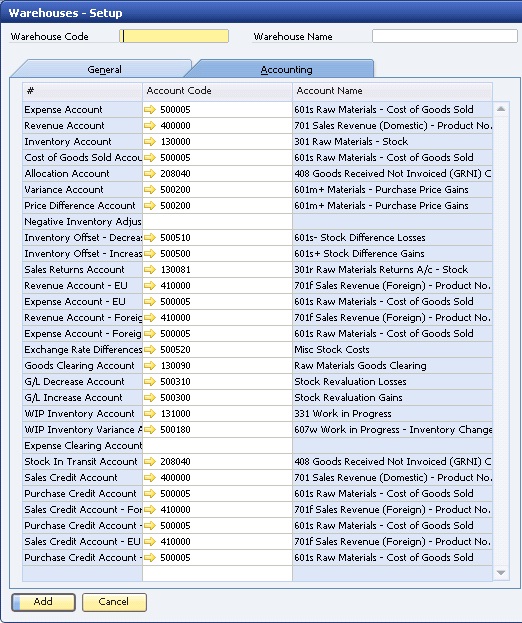

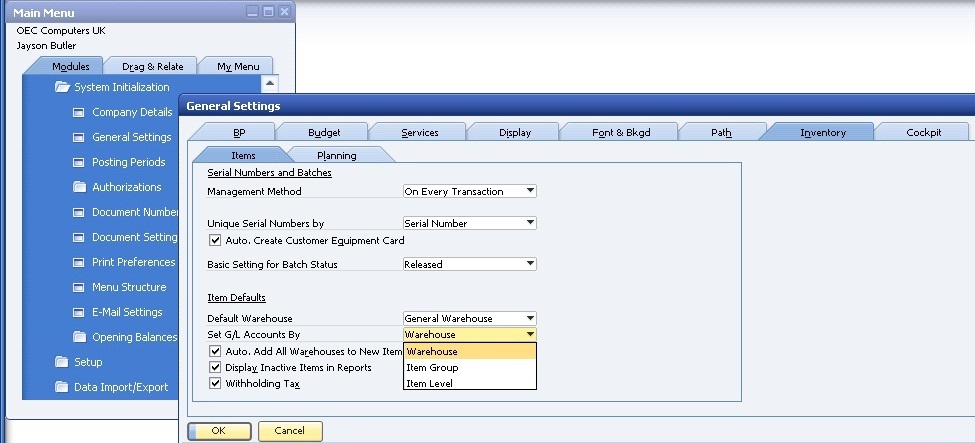

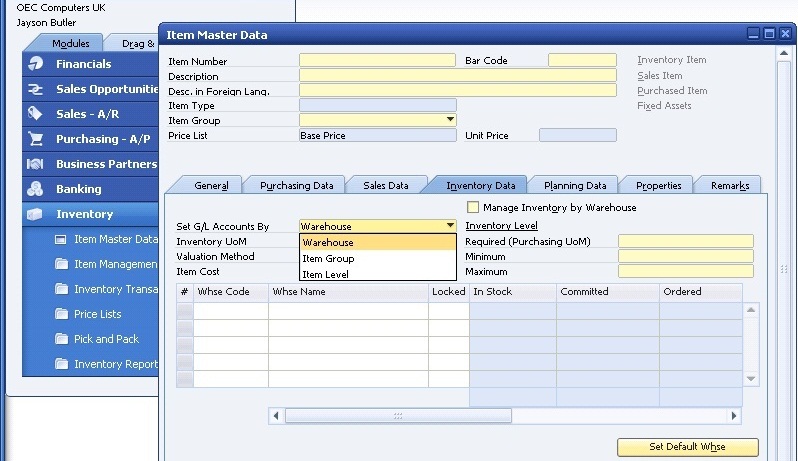

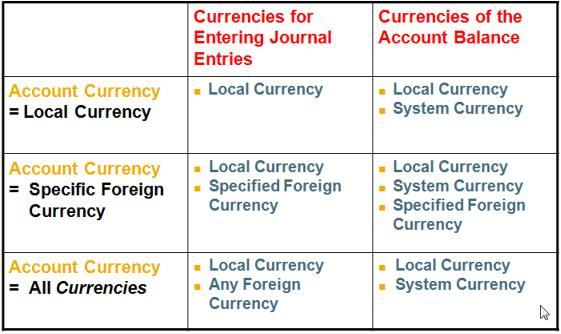

One, you define default G/L Accounts related to specific business process in the